A large monitor shows the New York yen-dollar exchange rate hitting ¥158 on Saturday afternoon in Shibuya Ward, Tokyo.

19:19 JST, April 28, 2024

The yen has fallen to an all-time low against the US dollar, yet the government and the Bank of Japan have observed this without intervening.

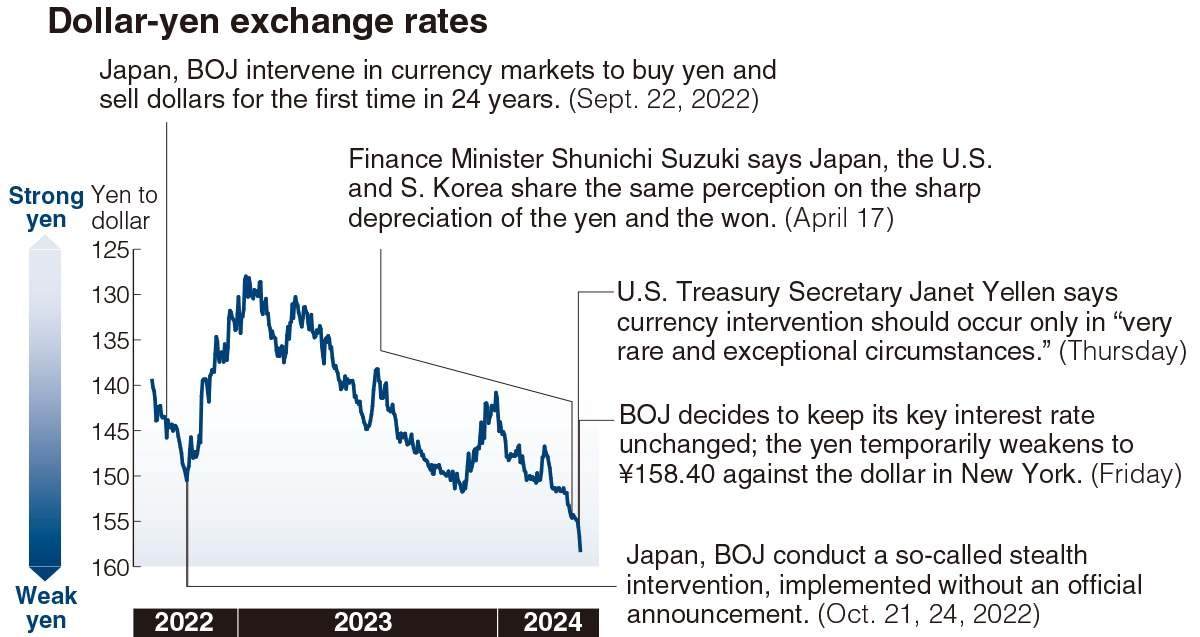

The yen’s decline hit the ¥158.40 range on Friday on the New York currency market, marking its weakest level in about 34 years. Business leaders are among those who have called for measures to correct the decline in the yen’s value.

“The fall of the yen has so far not had a major impact on the fundamental pace at which prices rise,” BOJ Governor Kazuo Ueda said at a news conference on Friday afternoon.

He made no major efforts to counter the yen’s decline, which has decisively led to a market trend of selling the yen and buying the dollar.

As many market players expected, the BOJ decided to maintain its current monetary policy. The same players thought that Ueda would propose to quickly implement an additional interest rate increase. If the yen remains weak in the long term, prices risk rising at a rate higher than the 2% that the central bank considers a stable inflation target, and a rise in commodity costs as a result of such a price. An increase could cause consumer spending to stagnate.

However, Ueda’s comments at the press conference were taken as a sign that the BOJ will tolerate the current situation. As a result, just half a day after the end of his press conference, the yen fell by more than ¥1.50 on the New York markets.

Defensive line

The attempts by the government and the BOJ to intervene in the market by buying the yen and selling the dollar have created a sense of caution in the market, increasing the sense of uncertainty.

In September 2022, the first yen purchasing intervention in 24 years took place immediately after a press conference for the central bank’s Monetary Policy Meeting with then BOJ Governor Haruhiko Kuroda.

Market intervention occurred again in October 2022 after the yen fell to a rate of ¥151.90 against the dollar. Market players thus assumed that ¥152 against the dollar was the government’s “line of defense.”

This time, however, no signs of intervention were seen after Ueda’s press conference. It was believed that the ¥155 rate against the dollar would be a new line of defense, but even when the yen fell well below that line, Japan did not intervene.

Statements from cabinet members have also changed.

On March 27, as the dollar climbed to ¥152, Finance Minister Shunichi Suzuki warned speculators, saying, “We will act decisively against any excessive move,” and the yen-dollar exchange rates stabilized at some level way.

On April 17, the finance ministers of Japan, the United States and South Korea met and said in a joint statement that they recognize “the serious concerns” of Tokyo and Seoul about the recent sharp depreciation of the yen and the won. The declaration was seen as a “basis” for market intervention.

But on April 25, a week later, US Treasury Secretary Janet Yellen told Reuters that currency intervention should only take place in “very rare and exceptional circumstances”, which would put cold water on market speculation.

Suzuki softened his earlier statements at a press conference after a cabinet meeting Friday: “We will closely monitor developments and implement all possible measures.”

Time, scale

The business community has also expressed concerns about the excessive depreciation of the yen.

At a press conference on Friday, Takeshi Niinami, chairman of the Japan Association of Corporate Executives, known as Keizai Doyukai, said the country is moving toward “good price growth,” with the economy boosted by wage increases that outpace prices. but warned that the weak yen could get in the way of this.

“I would describe the yen’s depreciation as extraordinary. I fear that Japan’s own national strength is in danger. I hope the foreign exchange market will normalize,” said Takayuki Morita, president of NEC Corp. Friday.

Since the BOJ is unlikely to suddenly change course and restrict lending through additional rate hikes or other policies, currency intervention is virtually the only way to halt the yen’s rapid depreciation.

But Japan appears to be thinking about the timing and scale needed for the intervention to have a large enough impact, as the trend of selling the yen and buying the dollar cannot be changed given the large interest rate differential between the United States and Japan.

Takahide Kiuchi, executive economist at Nomura Research Institute Ltd., said: “The government has an obligation to demonstrate to companies and the public that it is taking action to prevent the yen from weakening, and it remains highly likely that it will will intervene.”