TOKYOMay 31 (News On Japan) – With long-term interest rates steadily rising, Japan’s major banks have announced a significant increase in fixed mortgage rates starting next month.

In a home manufacturer’s showroom in Tokyo, the excitement of choosing a new home is tempered by concerns about rising mortgage rates.

‘I’m a bit worried. I’m afraid rates will rise.’

Many are concerned about the consequences of rising mortgage rates.

Homebuyers can choose between fixed-rate mortgages, where the interest rate remains unchanged for a set period of time, and variable-rate mortgages, which reset every six months and typically have a lower interest rate compared to fixed-rate loans.

Due to the continued rise in long-term interest rates, which are above 1%, the major banks announced the second consecutive increase in fixed-rate mortgages next month.

As a result, approximately 90% of customers at this home builder opt for a mortgage with a variable interest rate.

“Currently it is expected that borrowing at a variable rate will result in lower total payments, so I opted for the variable rate.”

‘I didn’t consider the flat rate option. I chose the one with the lowest rate.”

What lies ahead for mortgage interest rates?

Since the Bank of Japan (BoJ) ended its negative interest rate policy, fixed-rate mortgage rates have started to rise. However, rates for variable rate mortgages, which are the choice of most people, could also rise depending on the BoJ’s decisions.

Today the yen stood at 157 yen per dollar, and the long-term depreciation of the yen continues to put pressure on household finances.

The main reason for the yen’s depreciation is the interest rate differential between Japan and the US. There is market speculation that the BoJ could accelerate the normalization of monetary policy, including additional rate hikes, to curb the yen’s depreciation. If the BoJ decides to increase short-term interest rates, this could lead to a rise in variable-rate mortgage rates, resulting in higher repayment amounts.

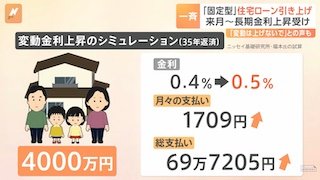

According to estimates from the Nissei Basic Research Institute, if the interest rate on a 40 million yen mortgage were increased by 0.1%, the monthly payment would increase by 1,700 yen, adding up to an additional 700,000 yen over the life of the loan.

Yuki Fukumoto, head of financial research at the Nissei Basic Research Institute, said: “The financial market is moving on expectations that the BoJ could implement one or two interest rate hikes this year.”

‘To be honest, I don’t want variable rates to rise.’

“If interest rates rise, we will have to reconsider our spending.”

To curb the yen’s depreciation, raising interest rates could increase mortgage repayment amounts, which would impose new financial burdens. The BoJ’s decisions will have a significant impact on the future of household finances.

Source: TBS