Japanese officials may have spent as much as ¥3.66 trillion ($23.59 billion) on Wednesday to pull the yen back from near 34-year lows, data from the Bank of Japan suggested on Thursday.

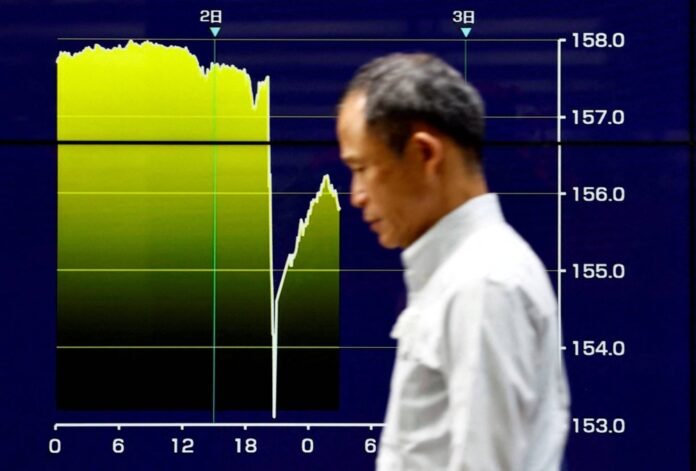

On Wednesday, the yen was trading at about ¥157.55 per dollar when it suddenly spiked, rising to ¥153 over the next half hour.

On Monday, the Treasury Department spent about 6 trillion yen on market interventions to prop up the yen after it fell to 160.245 yen for the first time since April 1990, the data showed.

The Treasury Department each declined to say whether or not it was behind the yen’s rallies, merely reiterating its willingness to intervene at any time to halt disorderly movements.

Currency transactions take two business days to clear, and Japanese markets will be closed for public holidays this Friday and next Monday.

The central bank’s projection for money market conditions next Tuesday points to a net receipt of funds of ¥4.36 trillion, compared with an estimate of ¥700 billion-¥1.1 trillion from money market brokers that excludes intervention.